It’s no secret that 2022 was a challenging year for technology companies. The rise in interest rates to fight runaway inflation caused a contraction in valuation multiples in public infrastructure technology companies. The decline catalyzed the current precarious fundraising dynamic for startups. While this decline in valuations was triggered by rising interest rates, has the performance of the underlying businesses faired similarly? Can technology companies still win in this environment?

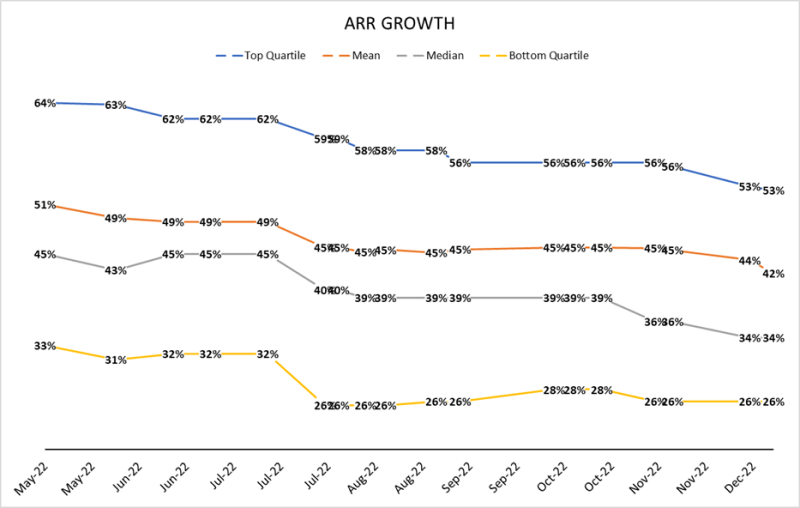

To answer these questions, Hewlett Packard Pathfinder has assembled and tracked a public enterprise infrastructure technology company cohort. Looking at the above graph using data from this group, Annual Recurring Revenue (ARR) growth broadly decelerated since May of this year. Now, why is that? Two theories:

As companies mature, their growth rates tend to fall as they get larger. Growing from $1M to $2M in ARR may represent a 100% growth rate, but only represents $1M of net new ARR. Maintaining that growth rate becomes harder to achieve as the base level of ARR grows; achieving a 100% growth rate is much more difficult if the company is starting with $100M of ARR. As it relates to this analysis, the mean and median ARRs of these companies are $1,064M and $564M respectively, so it might be logical to conclude this was “bound to happen at some point.”

In the current macroeconomic environment, large enterprises are, in aggregate, focusing on mission critical projects and not allocating new IT spend towards innovation or R&D related programs with new technology vendors.

SaaS companies that follow an enterprise sales business model can theoretically have an infinite rate of growth insofar as they have unlimited budget to hire sales and marketing professionals. As the macroeconomic outlook trends more negative and SaaS companies realize their customers’ budgets are shrinking, many SaaS vendors are seeking to “tighten their belts” by cutting headcount, thus reducing burn. Salespeople tend to have a ramping period between when they are hired and how soon they produce new revenue for the business. This ramp to productivity introduces a lag period of cash burn in which companies might not want to or be able to fund. Furthermore, given IT budgets are shrinking, salespeople might not be as productive as they once were, and SaaS vendors might not realize the same ROI on new salespeople they once did.

By not hiring new people in their sales organization, the ability to generate new revenue quickly goes away. Should the first theory prove correct, there wouldn’t be a significant impact on company strategy, however the second theory has broad implications given the following graph.

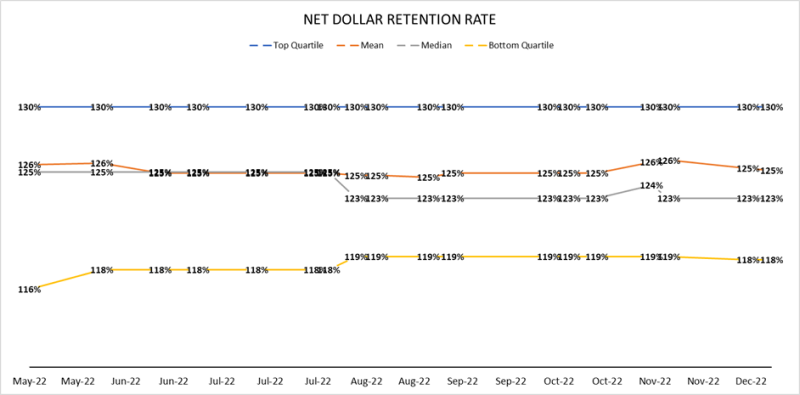

For the same cohort of companies, the net dollar retention rate has stayed largely flat. Existing customers are continuing to renew and increase usage / consumption. Enterprises, evidently, have little hesitation to continue spending on existing solutions and simultaneously increase their usage with these vendors.

What does this mean for technology startups?

• Early-Stage (Seed-Series A): New logo growth remains paramount as these companies are in the nascency of establishing their customer base. They may not have more than one large customer to upsell, so maintaining their go-to-market motion for new customers is critical from both a growth perspective and to inform product decisions.

• Mid-Stage (Series B-Series D): These companies have acquired a respectable handful of enterprise customers and are post product-market fit. Establishing a solid customer success strategy, from adoption to upsell, will be important as the company scales. In this environment, focusing on upsells will be an efficient use of their capital from a sales and marketing perspective and will make investors look upon the company more favorably.

• Late-Stage (Pre-IPO): A large customer base is very typical, and these companies may be a centurion, or close to it. They should strongly emphasize building out a repeatable engine to upsell their customers as that will be their primary growth driver and preferred KPI public equity investors use when evaluating the company’s prospects to generate free cash flow in the future. A strong customer success strategy implemented after an initial land with a customer will lead to adoption and increased usage of the company’s products, namely from identification of new use cases and will increase the usability across the enterprise.

Encouraging startups to drive a product-led growth / land-and-expand sales strategy is not new nor marvel. In this time where venture capitalists are reluctant to invest in non-(seemingly) perfect companies, capital efficiency is paramount as acquiring a new customer is much more costly from a sales and marketing perspective than upselling an existing one. Upsells, in this environment, are equally if not more important than acquiring new customers.

If you like this article consider subscribing to our bi-monthly newsletter to get information about our portfolio, solutions, and insights delivered to your inbox.