Contents:

State of Venture Capital and IPO Markets

New Investment: Rockset

Market Perspective: Cybersecurity

New Face at Pathfinder: Shehan Weeraman

Portfolio Company News

Welcome to Pathfinder Insights and our first issue of 2024! We have a number of exciting items to share in this issue but before we do, let's take a moment to celebrate the successes of 2023.

Last year was marked by significant achievements for Pathfinder and its portfolio companies. Two of our portfolio companies were acquired by HPE (Pachyderm and OpsRamp), we added several new start-ups into our portfolio (including Cequence Security and Aleph Alpha), and three of our portfolio companies were acquired (Fungible {Microsoft}, Arcion {Databricks}, and D2IQ {Nutanix}). The investment activity was a result of foundational work with our business unit colleagues to inform and advance HPE’s strategy in areas like AI, Sustainability, Observability, Data Services, etc.

Building on last year's momentum, we're excited to share our recent investment in search and analytics database startup Rockset, a company that's reshaping real-time data analytics for enterprises as the importance of real-time data analytics increases. Welcome Rockset!

In this issue we share our perspective on the venture funding environment as it continues to reset from the 0% interest rate period during COVID. We also share our market perspective on the ever-evolving landscape of cybersecurity. With the rapid proliferation of hybrid and multi-cloud environments, coupled with the advent of Generative AI, cybersecurity has become more crucial than ever before.

We are pleased to welcome Shehan Weeraman to the Pathfinder team as an Investment Analyst. Welcome Shehan!

State of Venture Capital and IPO Markets

As the venture market continues to reset from the COVID era’s 0% interest rate environment, deal volume and total capital invested is stabilizing around pre-COVID levels; 2023 activity was down 50% from its peak in 2021. This is a notable shift in investment focus, from large, late-stage rounds to earlier-stage companies with Seed and Series A rounds accounting for 38% of the funding compared with 27% in 2021¹. Even more noticeable as of late is the market focus on AI, with greater than 40% of recent transactions involving AI-related start-ups.

Valuations in this dynamic environment continue to fluctuate based on the individual company circumstances, for example AI is driving high valuations. However, overall valuations are down significantly compared to 2021, led by mid- and late-stage companies mirroring the correction in public markets and the uncertain paths to exit. Early-stage financings have proven more resilient with valuations increasing slightly.

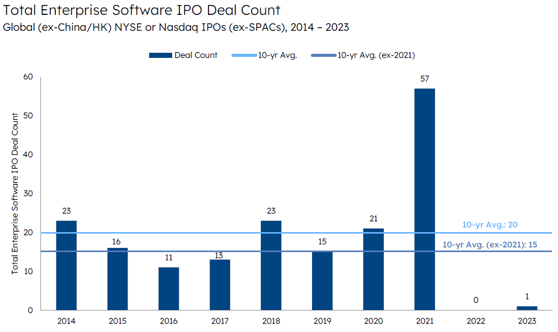

Figure 1 (see below) highlights the challenges in the IPO market with only one enterprise software IPO in the US for the past two years. Considering the potential backlog of companies awaiting public offering and the historical average number of IPOs per year over the last couple of decades, some projections forecast a backlog of almost 20 years. This highlights the high bar for a company to successfully go public in the current climate and the elongated cycle for return on investment.

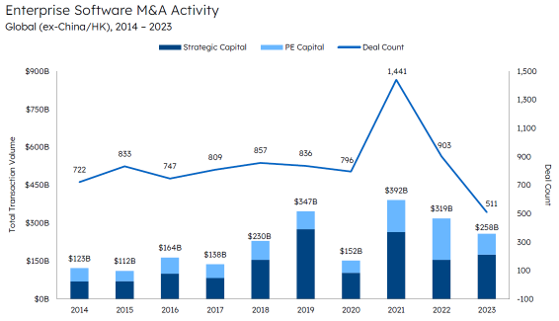

Similarly, while M&A is up in terms of dollars, it remains challenged in the number of transactions (see Figure 2). With higher interest rates increasing the cost of capital, larger companies are more focused on realizing near-term value-accretive deals.

As a result, investors are increasingly discerning, favoring the best-performing and most stable assets. Companies not at the forefront of their respective market will find it challenging to raise capital, and investors are looking to 2027 and beyond for realizing returns on their investments.

The role for Pathfinder in this environment is clear and unchanged, back top-quality companies aligned with HPE strategy to realize both financial and strategic returns.

Figure 1

Figure 2

Charts and data from Sapphire’s The State of the SaaS capital Markets report dated 1/30/24; Based on Pitchbook data pulled as of Dec. 31, 2023, S&P Capital IQ data pulled as of Dec. 31, 2023

¹Pitchbook data pulled as of Dec. 31, 2023; Sapphire Internal Analysis (Jan. 2024)

New Investment: Rockset

Last month, Pathfinder invested in search and analytics database start-up Rockset. As real-time data becomes more crucial in today's dynamic business landscape, Rockset enables enterprises to put real-time data into action and drive innovation, particularly in modern AI applications.

Rockset handles ingestion, storage, and query of real-time data with a modern, cloud-native architecture built to handle the most demanding workloads in a scalable and cost-effective way, all without needing to manage the underlying infrastructure. With the release of vector search capabilities last year, Rockset is positioned as a player in the highly dynamic and emerging field of Generative AI. With over 300 customers, including industry leaders like JetBlue and Meta, Rockset has emerged as a leading real-time data platform.

To learn more, please read the press release announcing our investment.

Market Perspective: Cybersecurity

The need to operate securely in hybrid and multi-cloud environments has been a significant driver in the evolution of cybersecurity. To add to this, Generative AI (GenAI) has expanded the attack surface in profound new ways, ushering the need for new “AI Security” solutions. As we prioritize both hybrid enterprise and AI offerings, securing applications, identities, data, and endpoints becomes ever more challenging.

To that end, Hewlett Packard Pathfinder continues to closely follow the cybersecurity landscape, segment the market, identify key themes, and make investments where it sees strategic value.

The cybersecurity landscape is evolving due to a variety of trends in the enterprise workplace. These trends include changes in how end users work such as the rise of hybrid work environments and the subsequent expansion of potential security vulnerabilities. Additionally, security organizations are increasingly adopting Zero Trust architectures, focusing more on security within the software development lifecycle, and dealing with a scarcity of cybersecurity professionals. These movements are shaping the way we classify sectors within the cybersecurity field. Click here for the full perspective.

New Face at Pathfinder: Shehan Weeraman

We are pleased to announce a new addition to the Pathfinder team. Shehan Weeraman recently joined the team as an Investment Analyst. Shehan will be supporting all aspects of the investment process, and we look forward to him expanding our coverage in the AI, Cloud, and DevOps areas.

Prior to joining Hewlett Packard Enterprise, Shehan was on the investment team at K Street Capital, an early-stage Venture Capital firm. In his free time, Shehan enjoys playing basketball, cycling, and spending time with his dogs.

Portfolio Company News

BigID Forbes Article: Data Security, Privacy, Compliance And Hygiene For AI

vFunction Announces Multiple Award Recognitions for Its Architectural Observability Platform

Alation Launches Data Culture Maturity Assessment to Measure the True Value of Data Initiatives

Dragos Appoints Bill Fehrman and Ekta Singh-Bushell to Board of Directors