Contents:

New Investment: Greenly

Update: Sustainability Perspective

Rockset: Powering Real-Time Search, Analytics and AI at Cloud Speed and Scale

Inside Our Portfolio: Q&A with BigID’s Dimitri Sirota

Pathfinder One-on-One

Portfolio Company News

Happy Earth Day! In this issue of Pathfinder Insights we’re pleased to announce our recent investment in Greenly, a carbon accounting startup that helps enterprises measure, track, reduce, and offset their carbon emissions. Be sure to check out our update to the Sustainability Perspective we published last year and learn how Greenly fits our sustainability investment thesis and accelerates HPE’s commitment to the environment.

Additionally, delve into our Rockset perspective, where we explore the power of real-time search, analytics, and AI at cloud speed and scale. Finally, we have two new series to offer deeper insights into our portfolio and investment strategies. 'Inside Our Portfolio' is a series where we engage in insightful conversations with our portfolio’s leaders. In this issue Paul Glaser, Head of Pathfinder, explores the intersection of data management, security, and sustainability with Dimitri Sirota the CEO of BigID. In our 'Pathfinder One-on-One' section, Todd H. Poole, Investment Director of Pathfinder, provides invaluable insights into sustainability and our investment in Greenly.

Join us as we celebrate Earth Day and our continued commitment to a greener, more sustainable future.

New Investment: Greenly

Last month, Pathfinder announced its investment in Greenly, a carbon accounting startup dedicated to helping enterprises measure, track, reduce, and offset their carbon emissions. This investment not only reflects HPE’s dedication to environmental sustainability but also underscores its broader strategy to address sustainability across its corporate, customer, and partner ecosystems.

"Achieving sustainability targets in hybrid IT environments can be complex and daunting endeavors for even the most sophisticated enterprises,” said Fidelma Russo, Hewlett Packard Enterprise CTO and EVP & General Manager, Hybrid Cloud. “HPE’s investment in Greenly aligns with the commitments we've made to our customers to help and support them on their sustainability journeys. We're excited to partner with Greenly in providing the tools necessary for businesses to monitor, track, and minimize their carbon footprint within their IT infrastructure." Click here to learn more.

Update: Sustainability Perspective

Last year, Pathfinder published its first sustainability-focused market perspective: Investing In a Greener, More Sustainable Future. In it, we discussed emerging trends within the sustainability landscape, summarized driving factors behind the uptick in ESG initiatives, and identified Carbon Accounting & Tracking and Carbon Capture & Sequestration as two key areas of focus relevant to Pathfinder and HPE.

In the intervening months, Pathfinder successfully led a Pre-Series B investment in Greenly, and as of February, our investment converted into equity as part of the company’s $54M Series B. This round cements Greenly as a leading player in the carbon accounting space, and we couldn’t be more excited about the company’s growth potential and strategic synergies it might offer HPE and its customers.

As we look to future quarters, one thing is certain: our commitment to sustainability will not end here. We continue to be intrigued by the carbon credit, carbon capture, and carbon storage spaces where there are many new and exciting technologies driving datacenter performance and efficiency that we are eager to explore further.

If you’d like to learn more, check out our website and stay tuned for future updates.

Rockset: Powering Real-Time Search, Analytics and AI at Cloud Speed and Scale

The ability to leverage real-time data for applications and informed decision-making has shifted from a competitive advantage for organizations with technology expertise to table stakes for most enterprises. According to 451 Research's 2023 Voice of the Enterprise Data and Analytics survey, most strategic enterprise decisions leverage real-time analytics in the decision process.

Real-time has become core to modern applications and capabilities across fraud detection, personalized recommendations, predictive fleet maintenance, real-time pricing engines, etc. and many of these use-cases are increasingly leveraging AI powered by real-time data.

Hewlett Packard Pathfinder believes real-time data and insights are critical to organizations of all sizes and industries, a shift from the past when these capabilities were more defining differentiators. Similarly, as real-time capabilities become more prevalent and complexities of operationalizing real-time data are abstracted away by modern platforms, we expect more and more batch workloads to transition to real-time. To remain competitive in a data-driven era, organizations not only require the ability to produce and capture real-time data, but also the appropriate tools to drive value with real-time data in a scalable and sustainable way. Click here for the full perspective.

Inside Our Portfolio: Q&A with BigID’s Dimitri Sirota

Welcome to our new series, 'Inside Our Portfolio', where we engage in insightful conversations with leaders from our portfolio companies. In this series, we aim to provide our readers with a firsthand look at the innovative strategies, technologies, and visions driving our portfolio forward.

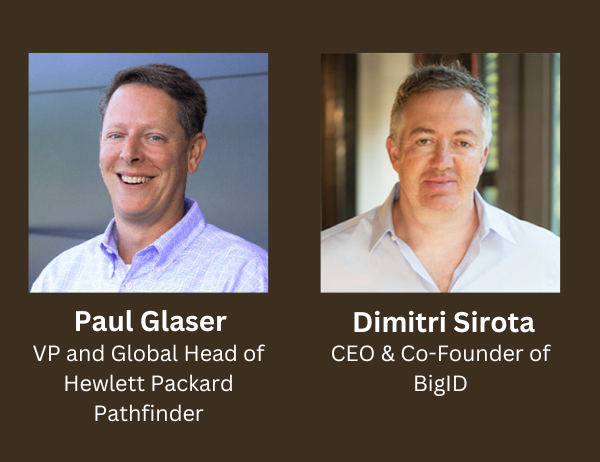

In this issue, we share excerpts from a webinar featuring Paul Glaser (VP and Global Head of Hewlett Packard Pathfinder) and Dimitri Sirota, CEO & Co-Founder of BigID, a security and compliance software start-up for the cloud and hybrid cloud and member of the Pathfinder portfolio since 2021.

PG: Can you provide an overview of BigID's mission and how it aligns with the evolving data landscape, particularly in terms of IT governance and security?

DS: Our journey began with a vision to empower organizations with comprehensive insights into their data ecosystems, especially in light of emerging privacy regulations like GDPR (General Data Protection Regulation) and CPRA (California Privacy Rights Act). Initially focusing on identity data, we soon expanded our scope to encompass a wide array of sensitive information. Our platform offers unparalleled data discovery, classification, and contextualization capabilities across various environments, from public to hybrid clouds and legacy data centers. With a robust framework for data action, including masking, redaction, and retention, we strive to equip companies with the tools needed to navigate the complexities of data governance and security effectively.

PG: Could you share a compelling customer use case that exemplifies BigID’s impact in the realm of data management and security?

DS: Our solutions address a myriad of use cases, all centered around identifying and safeguarding sensitive data. From facilitating cloud migrations to mitigating insider threats and protecting intellectual property, we enable organizations to proactively manage their data risk posture. Whether it's compliance with regulatory frameworks or safeguarding AI training datasets, our platform serves as a cornerstone for data-centric operations across various industries and regulatory environments.

PG: As AI adoption accelerates, how do you envision BigID’s role in facilitating AI-driven insights while ensuring data privacy and compliance?

DS: AI's reliance on unstructured data underscores the need for robust data management and governance frameworks. Our platform offers comprehensive capabilities for data discovery, classification, and curation, essential for training AI models ethically and effectively. By integrating seamlessly with AI workflows and ensuring compliance with regulatory standards, we empower organizations to harness the full potential of AI while safeguarding data privacy and integrity.

PG: How do you perceive your solutions complementing HPE's strategic objectives?

DS: Our vision aligns closely with the needs of HPE’s clientele, particularly in the realm of data security, compliance, and governance. With a shared focus on serving large, multinational organizations operating in complex regulatory environments, we see ample opportunities for collaboration. By starting with a deep understanding of our clients' challenges and objectives, we aim to offer tailored solutions that serve as a control plane for data governance and compliance. Whether it's enhancing AI data hygiene or ensuring seamless data integration within HPE’s ecosystem, our partnership holds the potential to drive transformative outcomes for mutual clients.

To learn more about BigID, please click here.

Pathfinder One-on-One

In our new 'Pathfinder One-on-One' section, we asked our Investment Director Todd H. Poole three questions about Sustainability and our investment in Greenly.

In our new 'Pathfinder One-on-One' section, we asked our Investment Director Todd H. Poole three questions about Sustainability and our investment in Greenly.

1. Why is sustainability an interesting area to invest in?

It’s one of those areas where good financial returns, critical environmental concerns, and important health and social well-being outcomes all intersect in interesting ways. When done right, sustainability investments don’t just positively impact the bottom line, they also promote better qualities of life, cleaner living environments, and lower rates of illness and disease. And that’s to say nothing of the exciting science, technology, and engineering advances that often accompany those investments.

At the end of the day, they offer an attractive mix of cutting-edge innovation, appealing financial returns, and altruistic opportunity not often found in venture capital.

2. Tell me why you were excited to invest in Greenly?

There were several signals that caught our eye in the twelve months leading up to our October 2023 investment. As a carbon accounting startup that helps enterprises measure, track, reduce, and offset their carbon emissions, Greenly is well-positioned to benefit from a rapidly expanding market driven by:

Growing regulatory pressures for businesses to reduce their carbon footprint,

Growing shareholder pressure for businesses to embrace ESG metrics, and

Growing customer and vendor requirements for their supply chain partners to have ESG targets and plans.

Further complementing these favorable market tailwinds were the company’s impressive month-over-month growth in customer count, revenue, and sales pipeline metrics. Such robust performance is uncommon for early-stage startups and indicated that Greenly had not just found product/market fit, but had done so while tapping a particularly deep vein of customer demand.

3. What can we expect with Greenly going forward?

Moving forward, I’m excited to see the company continue to grow as it focuses on three key areas: strategic partnerships, enterprise customers, and geographic expansion. For the first 16 months of its life, Greenly cut its teeth by winning thousands of SMB customers in France, all on its own. Over the next 16 months, I’m eager to see the company team up with strategic partners and go hunt the larger (and much more lucrative) enterprise space while simultaneously using the playbook it successfully honed in Paris to expand to new markets abroad like the US, the UK, the EU, and EMEA.