Authored by Punit Chiniwalla, Sr. Managing Director and Shehan Weeraman, Analyst, Hewlett Packard Pathfinder

Generative AI (GenAI) is rapidly transforming industries by automating tasks, creating innovative applications, and boosting efficiency. Hewlett Packard Pathfinder has been following the enterprise AI application space closely - meeting with startups, talking to customers, learning about technology advances, testing business models, and considering deployment modes.

Over the past two decades, packaged license software from established industry leaders like Oracle and SAP has faced growing competition from startups—now major players themselves—such as Salesforce and Workday. This transition had two major changes: (1) a shift from an upfront license to recurring subscription contracts, and (2) a shift from shipped software to cloud-based delivery. Today, cloud applications with subscription models (SaaS) have become the industry standard. That said, many enterprises still run certain applications within their own firewalls driven by concerns over data protection, intellectual property loss, latency, and unpredictable costs.

Enter the new wave of applications powered by AI, more specifically “GenAI first” applications, with a new list of questions. How will they meet enterprise needs, what problems do they solve, how will they get deployed and what does it mean for the future of the enterprise?

Unlocking Enterprise Value Through GenAI

Much like the Robotic Process Automation (RPA) startups of the last decade, such as UIPath, GenAI drives value primarily through increasing individual productivity and reducing manual processes. While this boosts overall employee performance, the primary return on investment lies in costs savings by reducing the need for additional headcount.

The adoption of GenAI in enterprise varies with some applications demanding minimal integration, while others require more robust infrastructure choices. These GenAI apps found initial adoption in “low hanging” tasks where data is easily accessible and the impact to revenue can be immediately felt. The bulk of GenAI revenue tends to come from:

• Customer Service: Chatbots, recommendation systems, and automated returns processing.

• Sales and Marketing: Personalized campaigns, content creation, and trend analysis.

Startups have recently started to find market fit in “medium hanging” areas where there are large operational spend or fixed budgets. While more complex in integration, these startups also tend to operate in areas where data is readily accessible, such as:

• AI Code Generation: Improving developer efficiency or replacing junior developers with autonomous coding agents.

• Governance and Cybersecurity: Automating policy compliance, risk mitigation, and enhanced threat detection.

A smaller number of startups target more complex enterprise problems like Supply Chain, Infrastructure Management, and Resource Optimization. These areas have been traditionally the world of consultants that develop custom platforms for enterprises. This trend continues with established consulting firms capturing significant revenue by offering professional services to build bespoke GenAI applications for large enterprises.

Infrastructure Choices: Public Cloud vs. Private Clouds

Public cloud providers have expanded their infrastructure offerings to customers for training, aiming to also secure the potentially more lucrative inference workloads when the service is in production. For example, AWS has been particularly aggressive in offering steeply discounted GPU/hour rates to select startups, while also setting up virtual private cloud (VPC) environments for data-sensitive customers. While public clouds promise superior economics, many customers are still hesitant to move even basic workloads to AWS, Azure, or GCP, let alone sensitive operations. Private cloud solutions, on the other hand, can be a viable option as it enables enhanced operational control and data security.

Uncertain Pricing Models

GenAI inspires a lot of excitement, but the business model to monetize these apps is still not established. In the case of a copilot like an AI coding assistant, a traditional per-seat SaaS pricing model makes sense, but per-seat pricing becomes misaligned with value as the customer may end up needing fewer seats over time. Some startups try to price a product based on the value it provides. This usually results in large contract sizes because of the cost savings. However, this method requires customized pricing for each use case and carries the risk of reduced value over time and threat of being undercut by a horizontal platform expanding from adjacent, lower-value areas.

The most promising pricing approach appears to be consumption-based pricing, in which the customer is charged by metering access to AI (for example, by prompt or token). This approach aligns the product with usage, but the appropriate price per use is unclear and that pricing is vulnerable to quick erosion with advances in technology.

Startups: Building on GenAI Foundations

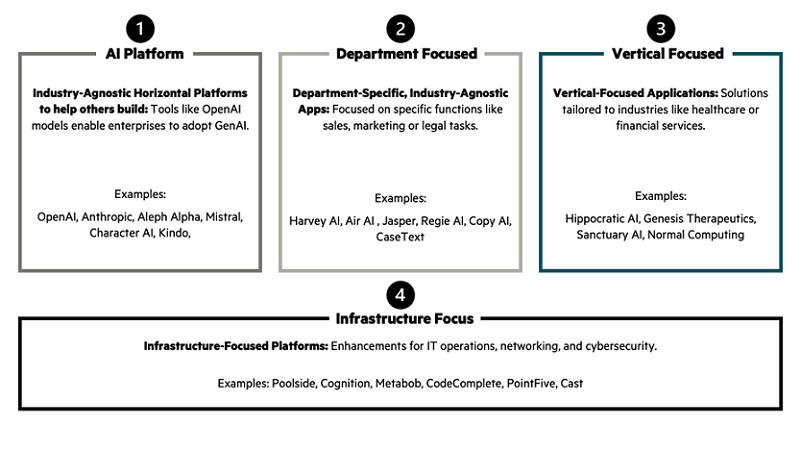

Pathfinder has met hundreds of Enterprise GenAI startups over the past year and characterized them into four key groups (see image below):

Industry-Agnostic Horizontal Platforms to help others build: Tools like OpenAI models enable diverse enterprises to adopt GenAI securely.

Department-Specific, Industry-Agnostic Apps: Focused on specific functions like sales, marketing or legal tasks.

Vertical-Focused Applications: Solutions tailored to industries like healthcare or financial services.

Infrastructure-Focused Platforms: Enhancements for IT operations, networking, and cybersecurity.

Opportunities for GenAI Enterprise Collaboration

Pathfinder is focused on fostering innovation at HPE through collaborative investments. If you are building something exciting in the Enterprise AI application space, we would love to hear from you. HPE can be a unique partner in three ways:

HPE as a Customer: HPE is actively looking for great tools that can be leveraged internally to supercharge our business.

HPE as a Partner: Joint sales opportunities through our HPE GreenLake and/or HPE Private Cloud AI (PC AI) products can accelerate enterprise sales motions.

HPE as an Investor: Pathfinder partners with startups to drive value to HPE and our customers, enhance our sales opportunities, and stay on top of emerging technologies and trends.

If you would like to share an exciting startup or trend with Pathfinder, please reach out to us: pathfinder-newsletter@hpe.com.

If you like this article consider subscribing to our bi-monthly newsletter to get information about our portfolio, solutions, and insights delivered to your inbox.