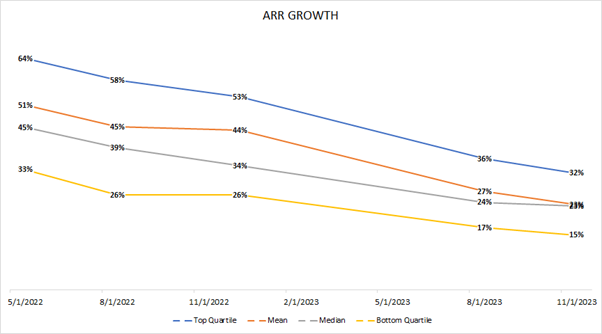

Last year, Pathfinder published a blog post reporting that within a cohort of infrastructure software companies, ARR growth is broadly decelerating. This trend has continued over the past few months, and in fact, the rate of deceleration has increased in the past year. Even top quartile performance has shrunk dramatically from 53% ARR growth to just 32% today (see graph below).

As advised in the previous coverage, companies should be focusing intensely on their customer success strategies. Attending to current customers is paramount, since retaining and expanding existing accounts will be the best means to maintain growth as the equity markets recalibrate.

Understanding net dollar retention rates

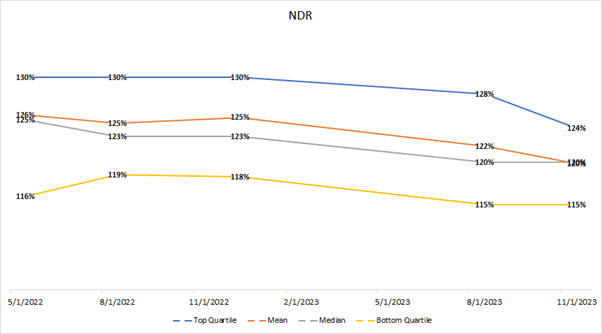

Net dollar retention rates have held relatively flat (see below graph) and have more recently started to decline, though not yet dramatically. This decline is seen mostly in the top quartile performers, and notably has not contracted much in the bottom performers. Perhaps this is an indication that expansion is slowing but retention is steady, although this metric is an aggregation of both data points so it is hard to say. If the macroeconomic picture continues to deteriorate, the moderate declines can accelerate into larger customer attrition.

Optimizing customer success in a challenging macroenvironment

While enterprise budgets are not expanding, the good news is they are not shrinking either. However, enterprises are looking for efficiencies now more than ever. A good customer success strategy can ensure a startup will weather the storm by retaining and possibly expanding spend with existing enterprise customers if use cases are proven, and ROI exists and can be measured.

In summary, data continues to confirm that infrastructure software growth is slowing at an increasing rate, even amongst the highest performers. As we enter tougher times, a relentless focus on customer success and retention is crucial.

What does this mean for you?

For Investors: Be sure to look for companies who are engaging in a robust customer success strategy, even if they are scaling well without issues.

For Early-Stage Startups: Attending to current customers is very important but so is getting your first few customers. Keep a customer-centric mindset when working with your first few design partners / customers but it is too early to invest in customer success.

For Growth-Stage Startups: Now more than ever is the time to think about customer success.

If you like this article consider subscribing to our bi-monthly newsletter to get information about our portfolio, solutions, and insights delivered to your inbox.